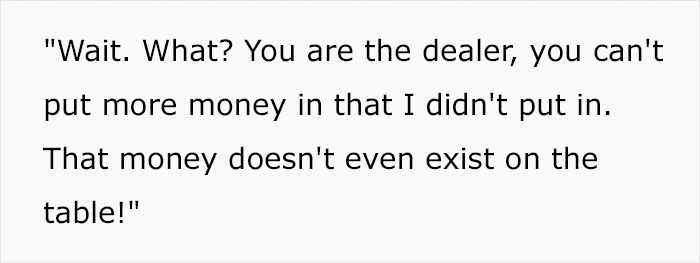

Major hedge funds had bet billions of dollars that GameStop’s shares would fall but they have faced major losses after Reddit users drove up the share price (it was $19 at the start of January but reached $330 in mid-afternoon on Wednesday in New York). These people see it as both a troll of the hedge funds they call “parasites,” and a real attempt at making big bucks.

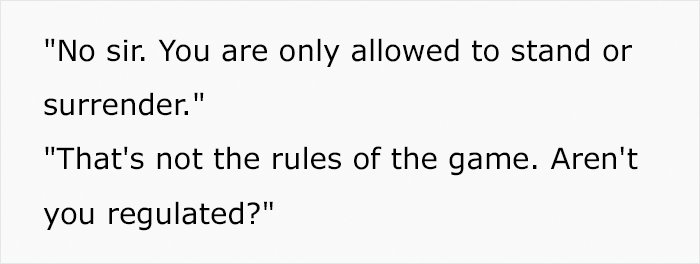

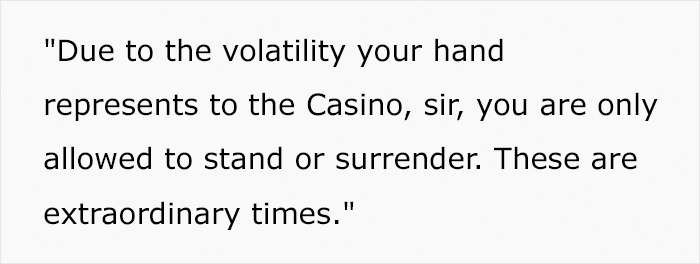

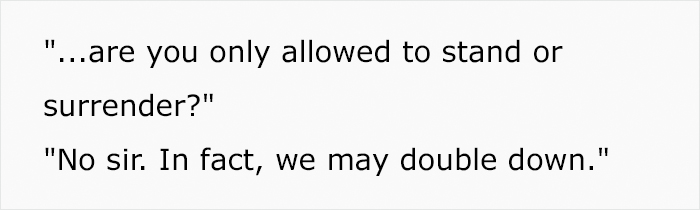

However, Robinhood and other popular online brokerages restricted trading in the high-flying stock, enraging individual investors who have sent it skyrocketing in recent days.

Listen beautiful relax classics on our Youtube channel.

These restrictions virtually left traders with only two options: hold or sell.

They also fueled a firestorm of criticism among users and even some members of Congress who have called for hearings on the matter.

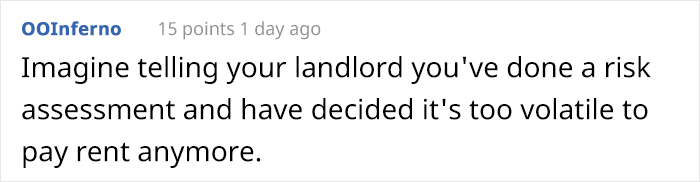

Disappointed and furious, investors who were getting the best of seasoned professionals interpret the trading restrictions as the latest sign that financial markets are stacked against individuals.

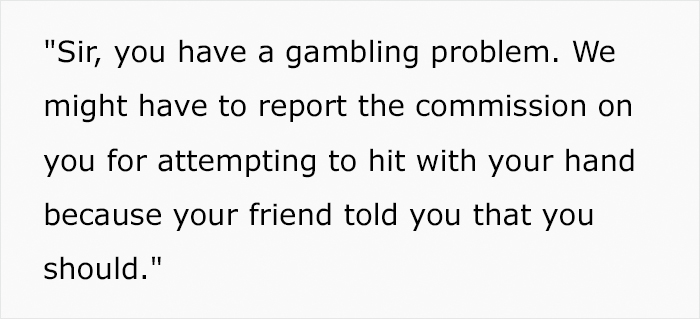

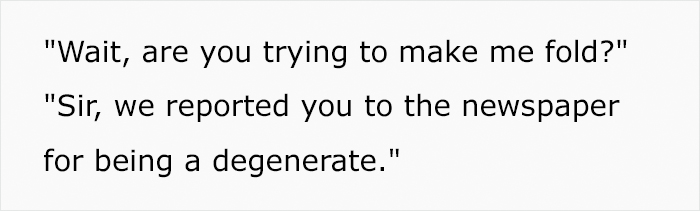

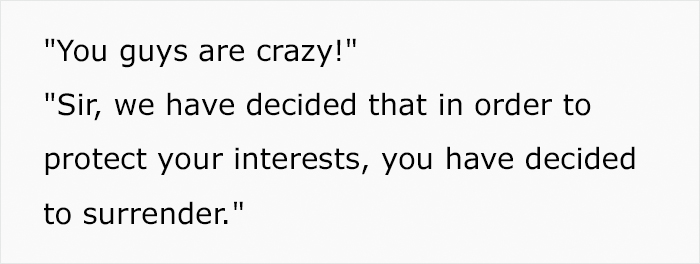

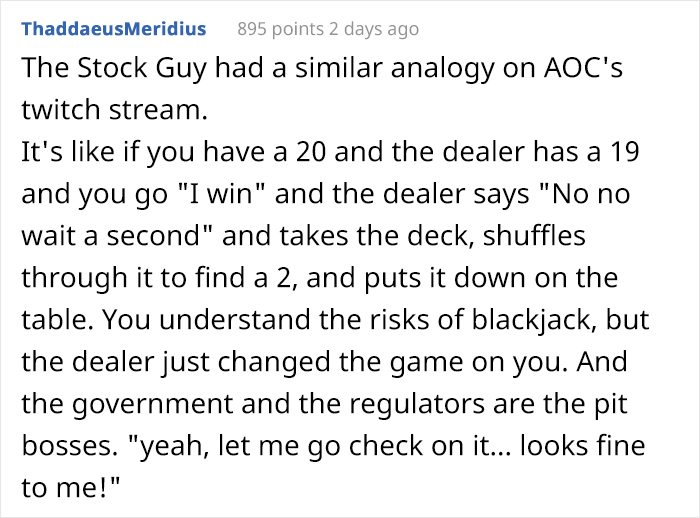

Trying to make sense of it all, Reddit user Palidor206 posted an analogy of the situation using a casino as an example and it’s clear there is no sense at all.

Image credits: Anna Shvets

Interestingly, Reddit isn’t the only place where you can find this analogy. On Sunday, Sen. Elizabeth Warren said the GameStop saga is just the latest “ringing of the bell” that there are problems on Wall Street — ones the Securities and Exchange Commission needs to fix.

The Massachusetts Democrat compared today’s stock market to a casino, where according to her big-money players are manipulating the markets through measures like pump-and-dump and stock buybacks to inflate stock prices.

“We need a market that is transparent, that is level and that is open to individual investors. It’ time for the SEC to get off their duffs and do their jobs,” Warren said on CNN’s State of the Union.

While we still don’t know how this situation will play out, there’s already one clear loser. Melvin Capital, a premier Wall Street hedge fund and a major short-seller of GameStop, lost 53% on its portfolio in January, a person familiar with the matter told CNN Business. Last week, prominent hedge funds Citadel and Point72 Asset Management extended a $2.75 billion financial lifeline to the fund.

Listen beautiful relax classics on our Youtube channel.

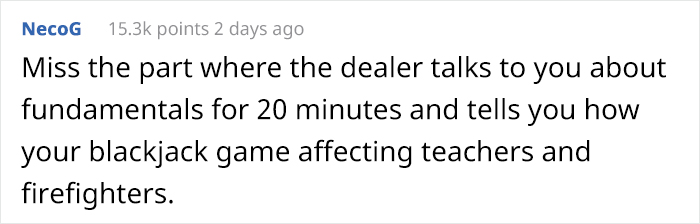

People think the analogy is spot-on

The post Person Explains How Billionaires Have Rigged Stock Trading Platforms To Screw Over Ordinary People With This Casino Example first appeared on Bored Panda.

Source: boredpanda.com